The rapid lift-off in rates over a short period of time has caught everyone’s attention. There is plenty of market commentary, along with the Federal Reserve’s May decision to hike short-term rates by 50 basis points, to argue why we are entering a prolonged higher rate environment. A higher rate environment can also affect commercial real estate loans besides making them more expensive.

While higher interest rates on commercial real estate loans are a bane to a project’s economic returns, it also causes another headache for sponsors – the potential for reduced loan proceeds. For a sponsor in need of maximum loan proceeds, the rising rate environment produces significant headwinds that can include diminishing equity returns and having to contribute additional cash into a deal.

To mitigate some of this risk, a sponsor may want to periodically spot-check their loan assumptions prior to approaching lenders for the loan request. If it cannot be avoided, it is better for a sponsor to quickly realize they are short on loan proceeds rather than to receive lender term sheets that fall short of the desired loan amount.

As a matter of ease, a sponsor can utilize a metric called the debt yield to size an approximate loan amount that will withstand lender scrutiny.

OPTION 1: DSCR COVENANT

Some may think loan-to-value (LTV) covenants like maximum 65% to 70% LTV determine the loan amount for properties, but they work in conjunction with a debt service coverage ratio (DSCR) covenant that requires a property’s net operating income (NOI) to sufficiently cover the annual loan payment by a specified amount. For example, a DSCR of 1.25x requires the property’s NOI (inclusive of any replacement reserves) to be a minimum of 125% of the annual loan payment. The loan amount is then determined to be the lesser of the two amounts that satisfy each covenant.

It should be noted that in addition to stabilized properties, loans involving heavy, value-add repositioning projects or ground-up developments also apply a DSCR covenant based on a stabilized NOI. Although these properties may not have existing cash flow to service the debt, these bridge and construction loans are sized so they can be “taken out” by the subsequent permanent loan based on the stabilized NOI. Though there are exceptions, most bridge or construction lenders back into their loans by sizing for the permanent loan. Therefore, underwriting a debt yield analysis to non-stabilized properties is effective as well. In this analysis, I will assume we are underwriting for stabilized properties, i.e., property NOI is fully realized and achieving market rents.

The DSCR sets the minimum required loan payment for the underwritten loan. When the annual loan payment is set, and loan interest rate and amortization assumptions are made, one can derive a maximum loan amount supported by the property’s NOI. This loan could either be a short-term (3- to 5-year) loan, often popular with bank lenders, or a longer duration (10+ years), “permanent” loan originated by agency, commercial mortgage-backed securities (CMBS) or life company lenders. Since these various lenders have different DSCR, interest rate and amortization requirements, the calculation could get a little cumbersome. A change in one of these variables will lead to a different loan amount.

Let us walk through an example of what a change in interest rates may do to loan proceeds:

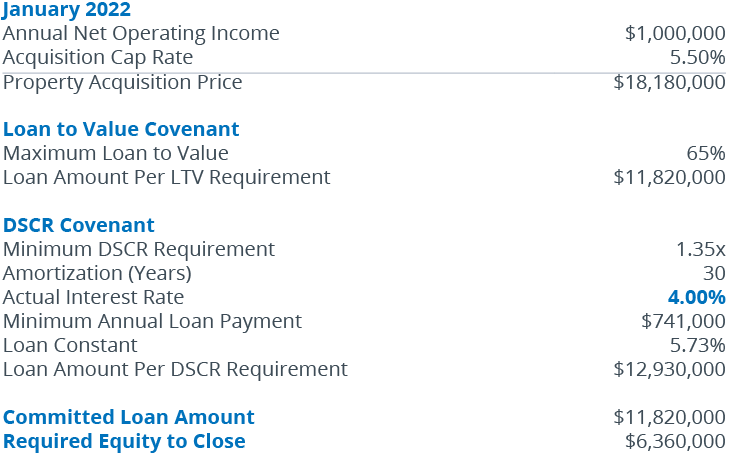

Assume a sponsor purchased a stabilized commercial property in January 2022 at a 5.5% cap with an annual NOI of $1 million. Also, the acquisition loan had the following loan covenants:

- Not to exceed 65% LTV of appraised value

- Not to exceed a DSCR of 1.35x based on a 30-year amortization and an interest rate of 4%.

In this example, the LTV covenant is the limiting factor regarding the loan amount, i.e., it is the lesser of the two amounts. The sponsor will have to provide $6.36 million of cash to close the transaction. What if the transaction did not close (or lock rate) in January 2022, but instead the deal funded (or locked rate) in April? This is how the loan sizing would look:

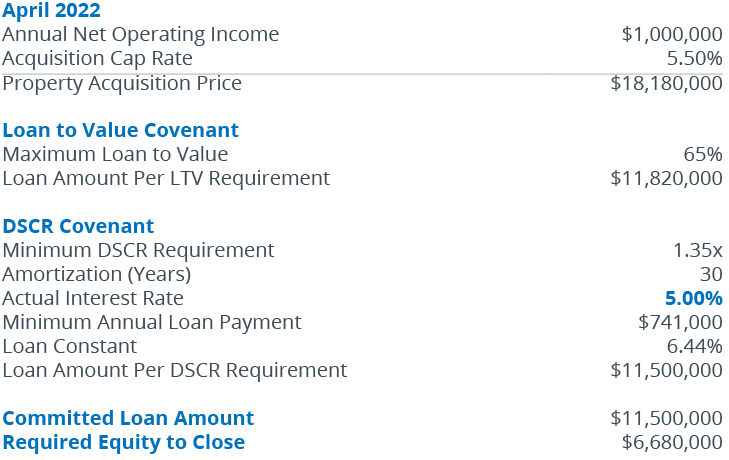

As you know, the treasury yield curve moved significantly during those months and pushed the interest rate from 4% to 5%. As a result, the limiting factor determining the loan amount changes from the LTV covenant to the DSCR covenant with a total loan commitment of $11.5 million. Now, the sponsor must come up with an extra $320,000 because rates moved against them over those weeks. Also, did you notice April’s much higher loan constant? From a return on equity perspective, April’s higher loan constant and the resulting negative leverage really impairs the project’s cash return.

OPTION 2: DEBT YIELD

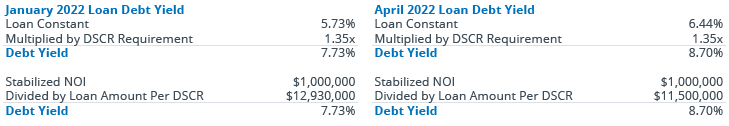

One must run through the DSCR exercise to have an accurate assessment of the potential loan amount a property can support. As mentioned earlier, it can get cumbersome since there are several variables at play including: DSCR, amortization and interest rate. Luckily, a perceptive individual saw the inherent relationship between all these variables and created a metric called the debt yield. It multiplies the loan constant (annual debt service shown as a percentage of the total loan amount) by the DSCR. If you recall, the DSCR is the lender’s requirement that the NOI sufficiently covers the annual debt service by a specified amount. A DSCR of 1.30x means the NOI is 130% of the annual loan payment. Therefore, if one multiplies the loan constant by the DSCR, one can derive the property’s NOI as a percentage of the loan amount, or the debt yield. Dividing the underwritten NOI by the debt yield will provide the loan amount (per DSCR calculation).

Using our previous examples, we derive the debt yield for the January and April loans:

The debt yield replaces the loan interest rate, amortization and DSCR variables with the property’s NOI. What the debt yield illustrates is the property’s NOI shown as a percentage of the total loan. If a property’s NOI remains unchanged, a higher debt yield results in a lower loan amount. The debt yield and loan amount are inversely correlated. Therefore, a higher debt yield signals a relatively higher annual loan payment. A sponsor looking for maximum loan proceeds will desire a low debt yield.

Prior to this latest surge in interest rates, senior lenders bidding on quality loans secured by properties such as multifamily or industrial distribution centers were willing to provide maximum loan proceeds (utilizing a 1.20x – 1.30x DSCR) if the loans underwrote to a minimum 7% debt yield. This was possible due to the low interest rate environment where of 3.5% money was readily available. Now with the market’s expectation that short-term rates are on their way to 3% by next year and long-term bonds selling off, it will be difficult for lenders to offer the same rates for loan amounts that bump into a 1.20x – 1.30x DSCR constraint.

CMBS lenders are now quoting loans with interest rates well into the 5% range, thereby pushing minimum debt yields to greater than 8%. The same loans quoted last year would have had debt yields in the 7% range. Loans generating debt yields in the 7% range are becoming more difficult to come by and will likely be limited to stellar deals where lenders want to win the business with their most aggressive pricing. Debt yields for the other deals, where the sponsor is looking for maximum loan proceeds, will be north of 8%. Since debt yields and loan proceeds are negatively correlated, the higher debt yields infer lenders are cutting loan proceeds.

TO RECAP

The sudden jump in interest rates over the last few weeks has caught everyone’s attention. If this rate environment is the “new normal,” sponsors in the market for commercial real estate debt may want to consider what higher debt yields mean for their desired loan proceeds. For sponsors on the fence about locking rate with a lender, the rate lock may serve as an additional hedge with respect to protecting cash in the deal. As sponsors get their arms around this market, the debt yield is a great metric to utilize.

Rob Murphy is Vice President of Structured Finance and Capital Markets. Based out of Los Angeles, he provides debt and equity placement services for Transwestern’s institutional and corporate clients nationwide.

SEE ALSO:

- Expediting Loan Closings in a Blistering CRE Market

- Optimizing Real Estate Sales Through Online Transactions

- The Financing Alternative: Sale-Leasebacks

RELATED TOPICS:

commercial real estate

real estate

structured finance

capital markets

real estate investment