In this three-part series, Transwestern examines downtown versus suburban real estate performance of the top 30 U.S. markets post-recession to develop a clearer picture of the resilience exhibited in many suburban areas. In Part 1, we lay out the historical data to reveal a more complex story than is often told amid assertions about the “death” of suburbia. In Part 2, we’ll focus on the demographic trends that will support the strength of the suburbs over the next several years. Finally, Part 3 will feature case studies detailing suburban recovery in select U.S. markets.

_______________________________________________________________________________________________________________________________________________

The current economic recovery has been one of the slowest and longest recoveries in history. Post-recession, the office market faced high vacancy and lowered rents with real estate investors looking for a silver lining. The early years of recovery positioned the downtown commercial real estate markets slightly ahead of their suburban counterparts nationally, with a lower vacancy rate and relatively controlled pipeline. These conditions, coupled with a younger generation wanting to live and work in the urban core, provided a boost to downtown markets. However, recent data shows that the suburbs, which have been making considerable progress, may have been written off a bit too soon by some prognosticators.

A LOOK AT THE FACTS

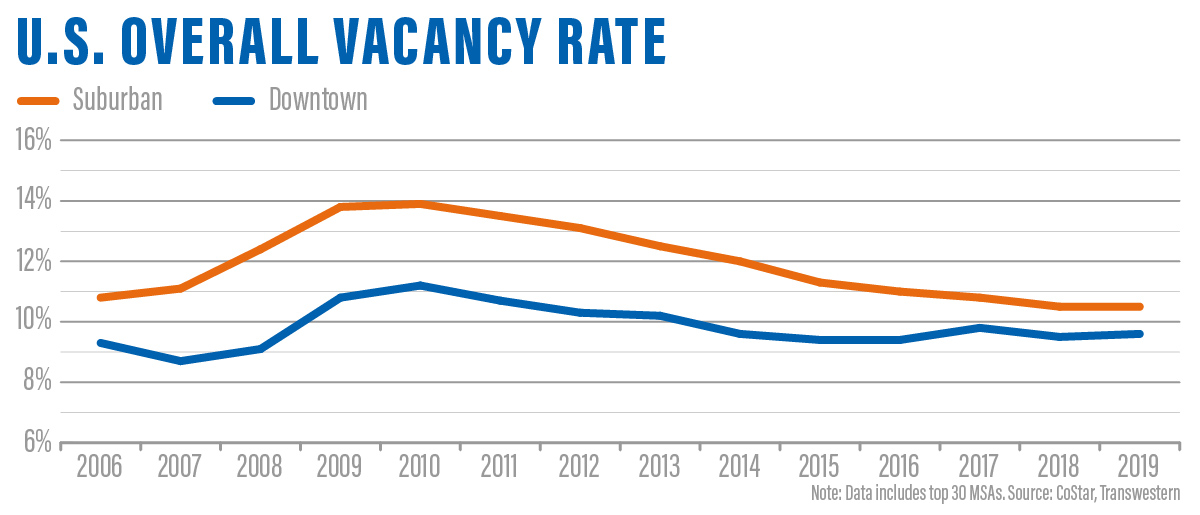

As anticipated, both the downtown and suburban markets experienced a rise in the office vacancy rate during the economic downturn. At its peak in 2010, the downtown vacancy rate was 270 basis points lower than the suburbs. Since then, vacancy both downtown and in the suburbs has declined. However, the suburban vacancy rate has made significantly more progress, dropping 340 basis points compared to a 160-basis-point decline for the downtown markets.

As of the second quarter of 2019, the downtown vacancy rate is only 90 basis points below the suburban rate, the tightest spread in recent history.

UNDERSTANDING THE DRIVERS

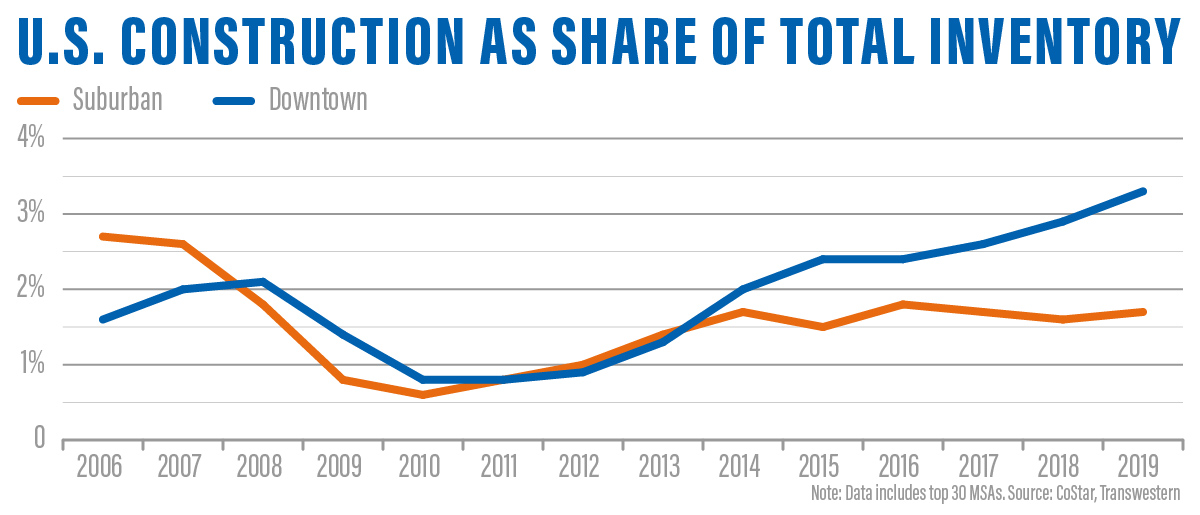

What caused such a sharp decline in suburban vacancy? The answer, in large part, has been a controlled pipeline. During the recession and early part of the recovery, both downtown and suburban markets controlled the pipeline to around 1% of total inventory, compared to the long-term average of 1.8%.

Beginning in 2014, the downtown market started to outpace the suburban market in the share of space under construction.

Tenants looking for upgraded space took advantage of lowered asking rent and competitive tenant improvement packages. This sparked a rise in new construction downtown, as real estate developers sought to capitalize on this flight to quality. In fact, since 2014, 72% of downtown leases of 500,000 square feet or greater were preleases for new construction. Examples include Google taking 1.3 million square feet at 550 Washington St. in New York City and Salesforce preleasing 864,000 square feet at 415 Mission St. in San Francisco.

The suburban market also snagged some notable prelease deals, including Pioneer Natural Resources Co. committing to 1.1 million square feet at 777 Hidden Ridge Drive in suburban Dallas and Boeing taking 923,000 square feet at 5301 Bolsa Ave. in suburban Los Angeles. The distinction is the overall amount of space under construction has been relatively controlled.

Of the total inventory under construction at the end of the second quarter, 3.3% is downtown, compared to 1.7% in the suburbs. And this is an important difference.

Although the downtown pipeline is 63% preleased as of the second quarter, the elevated amount of space under construction could pose a challenge. Landlords may face issues backfilling second-generation space that was vacated for new construction at a time when the economy is projected to decelerate.

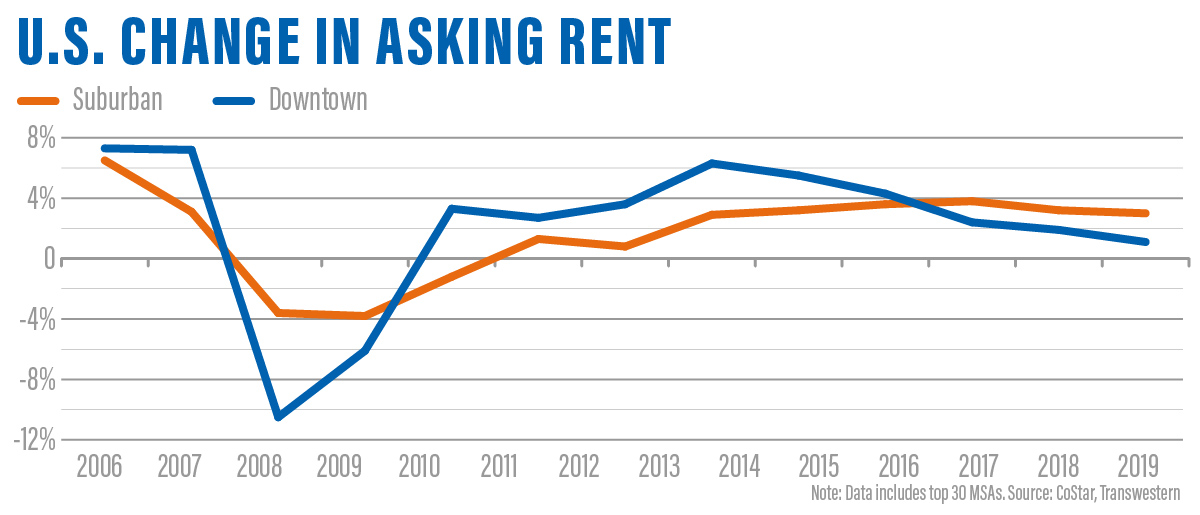

Not surprisingly, asking rents have responded accordingly. While the average downtown asking rent grew at a faster pace during the early part of the recovery, the growth rate peaked in 2014 and has since decelerated with the suburban growth rate surpassing it in 2016.

PROMISING FUTURE

The economic and real estate trends discussed here should shine a ray of light on what has been a tale of gloom surrounding many suburban markets. But past performance is not the only factor in play. The suburbs stand to benefit from future demographic trends, which will be discussed in Part 2 of our series. Notable local investment and renewed tenant interest will also assist suburban markets, and we will explore specific examples in Part 3.

Sandy McDonald is the Director of Market Research for the Midwest region, and Elizabeth Norton is the Managing Research Director for the Mid-Atlantic region.

SEE ALSO:

- Strength of Suburban Real Estate Part 2: Demographics Favor Suburbs

- Strength of Suburban Real Estate Part 3: Success Stories

- Cities and Suburbs: The Best of Both Worlds

- New Jobs Report Bodes Well for Commercial Real Estate

- Underwriting Real Estate Investment in a Mature Market

RELATED TOPICS:

commercial real estate real estate capital markets us job market us economy economic growth market reports office leasing agency leasing landlord representation office leasing strategy office building repositioning