Following a slowdown in 2023, when retailers spent much of the year unloading inventory, America’s top shipping ports posted strong container volume totals to kick off 2024. In fact, total cargo handled was 12.6% higher than the first half of last year, with eight of 10 ports recording double-digit gains ranging from 11.5% to 15.0%. While shipping totals remained below the record-setting volume in 2022, (with the exception of Port Houston), in the first six months of 2024 eight of 10 ports outpaced pre-pandemic 2019 and pandemic-ridden 2020 levels. The Port of Virginia joined Houston as the only seaports to also outpace 2021 totals.

.jpg)

Port Highlights – comparisons year-over-year and vs. pre-pandemic normalcy

(Ranked by total cargo volume through midyear 2024)

| 1 | Port of Los Angeles recorded steady growth during the first half of the year, posting a 14.4% increase in cargo volume when compared to the first six months of 2023. Totals also outperformed 2019 pre-pandemic levels by 4.3%. Since June 2023, exports have been higher every month when compared year-over-year. |

| 2 | After falling to No. 3 as it pertains to total cargo, Port of Long Beach moved back into the second spot after posting its busiest June ever, with a 15.0% gain in volume through the first half of 2024, the largest increase of the top 10 ports when compared to 2023. Long Beach also posted a 16.4% gain when compared to 2019, by far the highest increase of West Coast ports. |

| 3 | Despite sliding back to the third spot, the Port of New York and New Jersey experienced a 12.6% increase in cargo through the first half of 2024, including a 14% increase in June when compared to 2023. The total for the first six months of the year was also 15.2% higher than 2019. |

| 4 | Port of Savannah recorded the highest level of growth among East Coast ports when compared to the first six months of 2024. Total volume increased by 13.7%, benefitting from diverted cargo from Baltimore, especially from car manufacturers. When compared to 2019, Georgia ports handled 20% more cargo. |

| 5 | Port Houston set a record at the midway point of 2024, handling more than 2 million TEUs during the first six months of the year for the first time. As a result, cargo volume handled rose 12.9% when compared to the first half of 2023. When compared to 2019, the volume for the largest shipping port in the Gulf Coast increased by 43.6%, by far the highest level of growth in the U.S. Port Houston was also the only major U.S. ports to record higher cargo volumes than both 2021 and 2022 through the first half of the year. |

| 6 | As the nearest port to Baltimore, the Port of Virginia benefited from diverted cargo, contributing to a 13.4% increase in volume during the first half of 2024, its second highest total ever through midyear, behind 2022. Container volumes at the Port of Virginia also far surpassed pre-pandemic totals, joining Houston as the only ports with more than 20% growth when compared to 2019. |

| 7 | The Ports of Seattle and Tacoma finished the first half of the year on a str9ong note, recording the best month of 2024 in June. As a result, cargo volumes were 11.5% higher than the first six months of 2023. However, midyear totals remained 18.7% below pre- pandemic 2019 levels. |

| 8 | Several obstacles, including a drought in the Panama Canal and a software issue that caused a shutdown, impeded growth at Port Charleston during the first six months of 2024. When compared to midyear totals for 2023 and 2019, cargo volume was only higher by 1.2% and 2.8%, respectively. |

| 9 | In June, Port of Oakland recorded its best month for full imports in nearly two years, pushing its midyear cargo total 12.2% higher when compared to 2023. However, volumes remained 9.5% lower when compared to 2019 levels. |

| 10 | Projected fiscal year totals for Port of Miami indicate 2.9% cargo volume growth for 2024, which would result in an increase 8.4% when compared to 2019. South Florida ports anticipate accelerated cargo traffic, benefiting from a rise in nearshoring. |

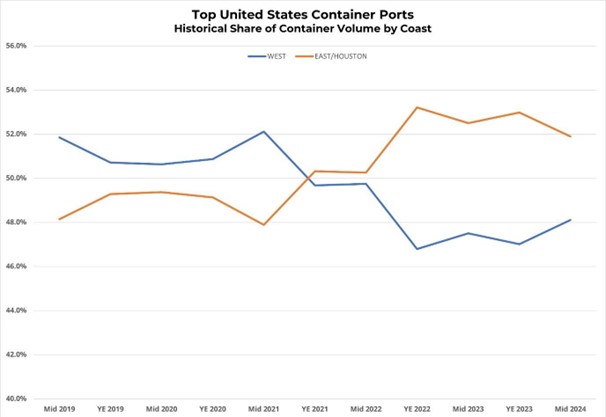

The West Coast increased its market share during the first half of 2024, led by the two largest ports, Los Angeles and Long Beach. Historically, West Coast ports account for the larger share of cargo, peaking at 52.1% midway through 2021. However, pandemic disruptions and stalled labor negotiations contributed to a shipping shift, rerouting cargo and decreasing the West Coast share of volume to 47.0% as of year- end 2023. Now, with the East and Gulf Coasts facing a labor strike, coupled with Red Sea diversions and a drought in the Panama Canal, the tide has turned somewhat as the share of overall cargo shipped to the West Coast has risen back to 48.1%.

Resilient consumer spending and a slow but steady increase in online shopping indicate that shipping volumes should remain elevated, at least in the short term. While much of the 2024 holiday merchandise may have already arrived onshore, rerouted cargo and looming tariffs may result in a rush on additional imports to avoid future freight rate increases, as well as the inflationary impact higher costs would have on consumers. As for where the cargo will flow in the future, population shifts and reshoring will likely mean that the East and Gulf Coast shipping totals will outperform.

Matt Dolly is Research Director for Transwestern’s Industrial Group and the firm’s Strategic Account Management program. He delivers local and national commercial real estate and economic trends, analyses and reports to team members, clients, prospects and the media.

SEE ALSO:

- Eye of the Industrial Market Storm

- Picture the Possibilities: Simplifying Data Analysis with GIS

- Stocked Retailer Inventories Result in First Cargo Volume Decrease Since 2020

- US Industrial Market Research Report – Q2 2024

- Elite 11 U.S. Industrial Markets

RELATED TOPICS:

commercial real estate

industrial real estate

market reports

tenant advisory

capital markets