As anticipated, the slowdown in cargo handled at the top 10 United States ports, which began at the end of 2022, continued into the first half of 2023. Warehouses remained flush with inventory, and consumer spending decelerated as excess savings dwindled amid persistent economic uncertainty. International trade also slowed as the reshoring of manufacturing to the U.S. continued to grow.

In total, container volume dropped 20% when compared to the first six months of 2022 and was 15.6% lower versus mid-2021. All top 10 U.S. ports recorded lower totals than a year prior – most double-digit percentage losses – and eight of 10 decreased when compared to 2021. However, the amount of cargo was more than 10% higher than in pandemic-ridden 2020 and on par with more typical, pre-pandemic 2019 totals.

PORT HIGHLIGHTS – COMPARISONS YOY AND VERSUS PRE-PANDEMIC NORMALCY

(Ranked by total cargo volume through mid-year 2023)

| 1 | The Port of Los Angeles experienced a 23.6% drop in cargo volume when compared to the first half of 2022, largely due to an extraordinarily weak February, while totals also underperformed 2019 pre-pandemic levels by 8.8%. However, near-record-setting June totals bode well for a strong second half of the year. |

| 2 | The Port of New York and New Jersey was the busiest nationwide for several months during the second half of 2022 and at the start of 2023. However, like its Los Angeles and Long Beach counterparts, volumes have cooled considerably, down 23.7% at midyear but still above pre-pandemic amounts. |

| 3 | The Port of Long Beach’s volume suffered the largest decrease among major U.S. ports, 25.5% lower than mid-year 2022, weakening considerably in June. Despite the slowdown, Long Beach still moved more cargo during the first six months of the year when compared to 2019, the only West Coast port to do so. |

| 4 | Despite a volume decrease of 17.8% at the Port of Savannah when compared to the first six months of 2022, Georgia’s seaports recorded their second busiest fiscal year ended June 2023. Overall, Savannah remains in growth mode, with cargo totals 5.5% above pre-pandemic levels. |

| 5 | The Port of Houston has been the strongest performer thus far in 2023, experiencing only a 2.0% drop when compared to a record-breaking 2022. When measured against the previous three years, the Gulf Coast port’s cargo volumes have risen by double-digit percentage points, including 27.2% higher than pre-pandemic levels, by far the largest increase of all top U.S. ports. |

| 6 | Following a record-setting 2022, the Port of Virginia held its own during the first half of 2023, with cargo decreasing 14.8% when compared to YoY, lower than the 20.0% average for the top ports. However, volumes were 8.7% higher than more typical 2019 levels, which the Port anticipates will resume during the second half of the year. |

| 7 | Cargo has plunged at the Ports of Seattle and Tacoma due to the combination of a reduction in consumer spending and a disruption caused due to longshoreman negotiations. As a result, volumes are down 22.7% YoY and have fallen 27.1% when compared to pre-pandemic levels, by far the largest drop of any major U.S. port. |

| 8 | The Port Charleston ended the first half of 2022 at a fiscal year high. Thus far this year, cargo volumes are on a more typical 2019 pace, boosted by a strong June, though it fell 14.7% when compared to YoY. |

| 9 | Following a record-setting 2021, the Port of Oakland’s volume has declined considerably, affected most recently by lower consumer spending and high warehouse inventory levels, down 17.8% when compared to mid-2022 and 19.4% lower than pre-pandemic totals. |

| 10 | During the first six months of the year, cargo through the Port of Miami was slightly off the pace of 2022 but was 22.3% above 2019 levels, second only to Houston. Higher volumes are expected going forward as the region benefits from the growth of nearshoring. |

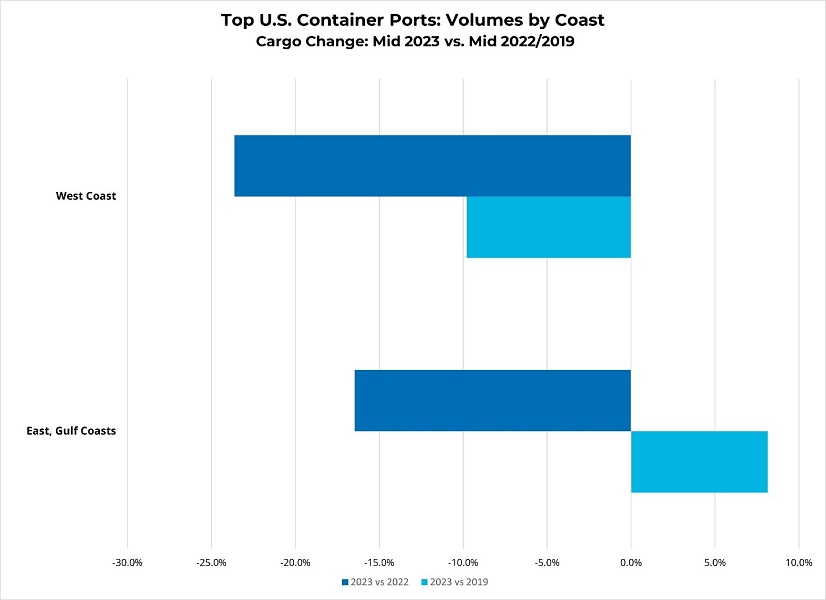

The shipping shift away from the West Coast ports continued. When comparing cargo volumes, the West Coast fell 23.6% compared to 2022 and 9.8% versus 2019, while the East and Gulf Coasts decreased 16.5% YoY but recorded an 8.2% gain versus pre-pandemic levels. Moreover, of the seven ports that recorded gains over pre-pandemic levels, six were on the East and Gulf Coast ports.

While labor issues that hindered West Coast ports have subsided, population shifts and reshoring have each contributed to rerouted shipping. The southeastern U.S. region between Charlotte and Houston has been the beneficiary of domestic migration, resulting in more product deliveries needed in these expanding areas and contributing to warehouse growth in the corresponding metros. Learn more here. Additionally, as the U.S. shifts trade to other parts of the world, connections with the East and Gulf Coast ports are more efficient.

Ports on the East and Gulf coasts are investing in infrastructure in anticipation of continued growth. However, the Ports of Los Angeles and Long Beach have not given up – both have improvements and expansion projects underway as they remain the country’s busiest gateways and hope to recover lost imports.

As for the remainder of this year, cargo volumes are expected to pick up (a reversal from 2022) but should not result in a chaotic holiday shipping season because inventory levels remain healthy. Moreover, consumer spending is anticipated to slow as rising credit card balances and looming student loan payments are likely to result in a further reduction in purchasing power, keeping import volumes at a manageable level.

Matt Dolly is Research Director for Transwestern’s Industrial Group and the firm’s Strategic Account Management program. He delivers local and national commercial real estate and economic trends, analyses and reports to team members, clients, prospects and the media.

SEE ALSO:

- Industrial Rolls with the Punches

- Picture the Possibilities: Simplifying Data Analysis with GIS

- Elite 11 U.S. Industrial Markets

- Forecasting the Future of Warehouse Demand

RELATED TOPICS:

commercial real estate

industrial real estate

market reports

tenant advisory

capital markets

.jpg)