TARIFF-DRIVEN RECORD IMPORTS EXPECTED TO DECELERATE

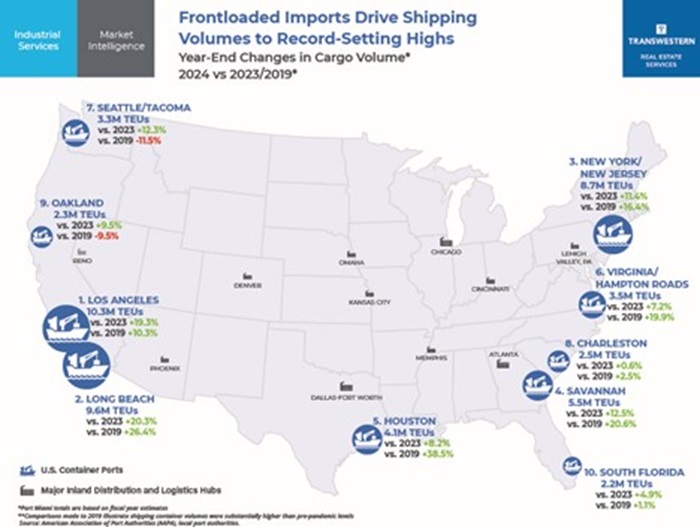

Tariffs were a major policy issue leading up to the 2024 election and have become part of the daily vernacular in global trade news since the outcome. Facing the potential of increased costs, and with consumers continuing to spend, retailers frontloaded imports during the year's second half. This followed a replenishment of goods earlier in the year after much of the excess pandemic “just-in-case” inventory was unloaded in 2023. As a result, cargo levels rebounded, and the top 10 U.S. shipping port regions recorded an increase in cargo volume of 13.1% over 2023 and were 13.7% higher than 2019 pre-pandemic levels, growing at an average annual rate of 3.2%.

All regions posted gains in 2024, with five recording double-digit increases, including the four largest ports. The West Coast’s Port of Long Beach led the way, increasing by 20.3% compared to 2023, resulting in its highest-ever total. On the East Coast, the Port of Savannah experienced the most growth, with total cargo volume increasing 12.5%. The Port of Houston joined Long Beach with a record-setting total, accomplishing that feat in three of the past four years.

PORT HIGHLIGHTS

(Ranked by total cargo volume in calendar year 2024)

| 1 | Following consecutive annual decreases in 2022 and 2023, cargo volume at the Port of Los Angeles jumped 19.3% during 2024, exceeding 10 million TEUs for the second time ever. The pace of growth was especially strong during the second half of the year, with an acceleration of 23.9% when compared to year-over-year. 2024 volume was 10.3% higher than that of pre-pandemic 2019. |

| 2 | The Port of Long Beach boasted its highest-ever annual cargo total, increasing 20.3% in 2024; it was the only major U.S. shipping port to exceed 20% YoY growth. This followed losses the previous two years. Long Beach’s latest annual total was also 26.4% greater than pre-pandemic levels, growing at an annual average of 5.5% over the past five years, the highest level of all major West Coast ports. |

| 3 | After recording the largest drop of all major U.S. ports in 2023, the Port of New York/New Jersey rebounded to post an 11.4% gain in 2024. Cargo volume was also the third-highest annual total on record and 16.4% above 2019 totals. |

| 4 | The Port of Savannah’s cargo volume was significantly higher in 2024, growing by 12.5% vs. 2023 and 20.6% compared to pre-pandemic 2019, representing the highest growth level among East Coast Ports. Georgia’s largest port has experienced an increase in shipping totals for seven of the past eight years, recording an average annual growth rate of 5.2%. |

| 5 | The Port of Houston has experienced the largest amount of cargo growth post-pandemic, averaging 7.0% annual growth over the past five years. As for 2024, total volume increased 8.2%, surpassing four million TEUs for the first time, and was 38.5% greater than 2019. |

| 6 | Cargo volume at the Port of Virginia increased by 7.2% in 2024, posting its second-highest annual total. The port became the first major port on the East Coast to power operations with 100% clean energy. Shipping totals were also nearly 20.0% higher than in 2019. |

| 7 | Following declines in three of the previous four years, the Ports of Seattle and Tacoma recorded double-digit annual cargo growth for the first time since 2021, increasing 12.3% in 2024. Despite recovering nearly all of its 2023 losses, total volume remained 11.5% lower than pre-pandemic levels, the largest drop among the major ports. |

| 8 | The Port of Charleston recorded the smallest gain in 2024, as cargo volumes increased by less than 1.0% and were 2.5% higher than pre-pandemic levels. |

| 9 | After falling for five consecutive years, cargo volumes at the Port of Oakland increased by 9.5% in 2024, positioning it higher than the 10th-ranked spot for the first time since 2020. Shipping totals remain lower than pre-pandemic levels, declining by an average of 1.7% since 2019. |

| 10 | The South Florida combination of Port Miami and Port Everglades recorded cargo volume gains of 4.9% in 2024, posting its third-highest annual total and a slight gain over pre-pandemic levels. |

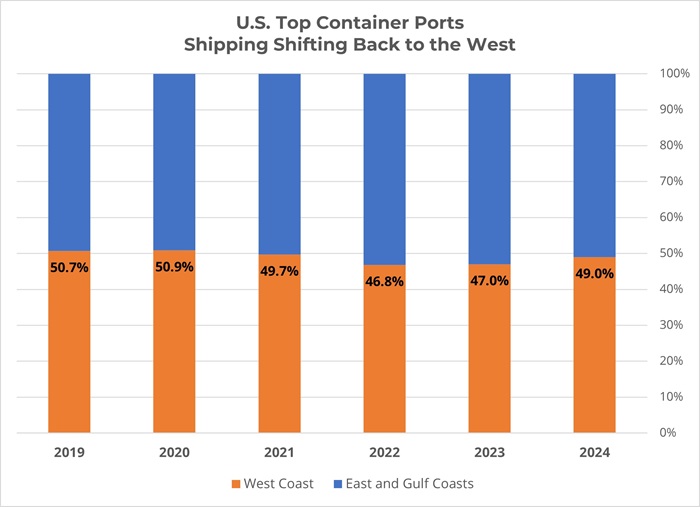

The West Coast benefitted most from the increase in cargo, continuing the trend of the first six months of the year, as the threat of a longshoreman labor strike hovered over the East and Gulf Coast Ports. In 2024, West Coast port volumes increased at an average of 17.8% and accounted for 49.0% of cargo volume. While that is less than half of the top 10 port region total, it represents a significant increase from 47.0% in 2023.

With the potential for rising tariffs, port volumes are expected to remain elevated in the short term. However, tariffs are intended to increase onshoring, and according to a recent study by Bain & Company, 81% of companies report that increasing production closer to home is integral to their plans. Additionally, in 2023, Mexico surpassed China as the U.S.’s top trading partner, while Canada did the same in 2024. Production closer to home reduces the need to overstock inventory and decreased dependency on overseas shipping. Furthermore, increased trade within North America would result in greater distribution of goods by rail and highways. Those trends, combined with pre-loaded warehouse inventories and an anticipated slowdown in consumer spending, would likely result in a reduction in shipping port volumes for the latter half of 2025.

Matt Dolly is Research Director for Transwestern’s Industrial Group and the firm’s Strategic Account Management program. He delivers local and national commercial real estate and economic trends, analyses and reports to team members, clients, prospects and the media.

SEE ALSO:

- Eye of the Industrial Market Storm

- Picture the Possibilities: Simplifying Data Analysis with GIS

- Stocked Retailer Inventories Result in First Cargo Volume Decrease Since 2020

- US Industrial Market Research Report – Q2 2024

- Elite 11 U.S. Industrial Markets

RELATED TOPICS:

commercial real estate

industrial real estate

market reports

tenant advisory

capital markets