Something felt a bit different at the most recent annual NAIOP I.CON East conference. The past several years, the mood in meeting rooms and hallways was jubilant, as the industrial real estate market has been on an unprecedented run of expansion. This year, sentiments were more mixed.

What changed?

Market activity cooled considerably during the past few quarters, and high interest rates put pressure on costs for all parties. In addition, there has been a transition from a “goods-only” economy during the pandemic to a “goods & services” economy post-pandemic. As a result, transactions have tapered, and new developments are no longer flooding the market.

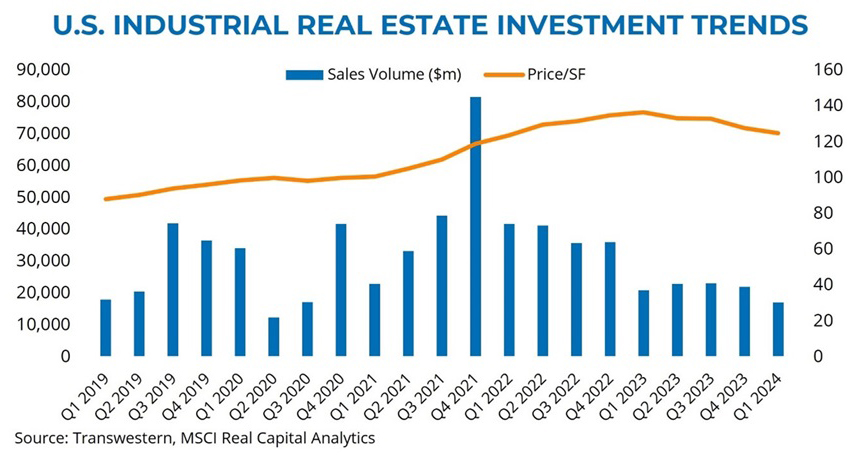

Though investment activity slowed in 2023, it showed signs of leveling in Q1 2024. Investors gradually adjusted to higher interest rate levels, encouraging increased capital deployment. Generally, pricing has not been adversely affected, indicating resilience and continued interest in industrial assets.

Some markets appear overbuilt and are struggling to find supply-demand balance. However, there is more to each market’s story than initially meets the eye. For example, Savannah, Georgia, was thought to be an overbuilt market, but the port region recorded a higher level of net absorption than Atlanta year-over-year (Q1 2022 – Q1 2023), which has seven times more inventory. In core markets where availability remains scarce, more investors are considering older, value-add assets, measuring whether lease-up will cover upgrade costs.

Today, whether you are a builder, investor, landlord or tenant of industrial space, the mood is one of reflection, research and reinforcement of strategy.

Here are five themes we believe will play a significant role in industrial decision-making in coming quarters:

- Continued supply chain interruption and delays in deliveries are expected, mostly affecting East Coast ports, which are also grappling with labor talks.

- Geopolitical pressures are driving capital towards the U.S., and this increased investment is sure to benefit the industrial sector.

- Nearshoring trends make Mexico an appealing opportunity – particularly for manufacturing and logistics – driven by factors like labor costs and geopolitical stability.

- Nearshoring can also lead to faster delivery times for products shipped to the U.S. and give birth to new industrial growth markets such as Laredo, Texas.

- Retailers, wholesalers, and manufacturers are ramping up inventories, and (though not quite at the “just-in-case” levels of 2021 and 2022), port container volumes are higher year-over-year and have surpassed pre-pandemic 2019 levels.

Despite short-term leasing uncertainties, the long-term outlook for industrial real estate remains positive, supported by strong consumer spending, evolving consumer habits, strategic investments logistics and manufacturing, and ongoing shifts in global supply chains.

We are closely watching for signs of an economic downturn or recession that could affect rental dynamics and tenant affordability, posing risks to market stability. Even if this transpires, most market players believe the industrial asset class is the one most likely to soonest stem the tide and see deal activity ramp up once again.

SEE ALSO:

- Picture the Possibilities: Simplifying Data Analysis with GIS

- Stocked Retailer Inventories Result in First Cargo Volume Decrease Since 2020

- US Industrial Market Research Report - Q1 2024

- Elite 11 U.S. Industrial Markets

RELATED TOPICS:

commercial real estate

industrial real estate

market reports

tenant advisory

capital markets