Four Drivers of Economic Vitality in Turbulent Times

While markets across the U.S. face many of the same challenges brought on by global economic and geopolitical events, the severity, response and long-term impact can vary dramatically.

As the 7th largest MSA in the country, South Florida has remained a highly sought-after destination for people and businesses and a primary industrial real estate market. The region’s popularity and resilience can be attributed to four key demand drivers – consumption, growth, hospitality and trade – that balance the market and create stability.

Despite economic challenges, these drivers work alone and together to sustain South Florida as one of the world’s key gateway markets.

Population & Employment Growth Impact Consumption

As one of the country’s primary port markets, South Florida makes up nearly 30% of the Sunshine state’s overall inhabitants with an estimated 6.2 million people. The region’s population increased by nearly 11% from 2010 to 2020, with additional growth anticipated as migration to the Sunbelt continues.

Over the last 10 years, the MSA’s GDP has increased by 64%, and while the labor market cooled at the outset of the pandemic in 2020, employment swiftly recovered in 2021, leading to significant job growth last year.

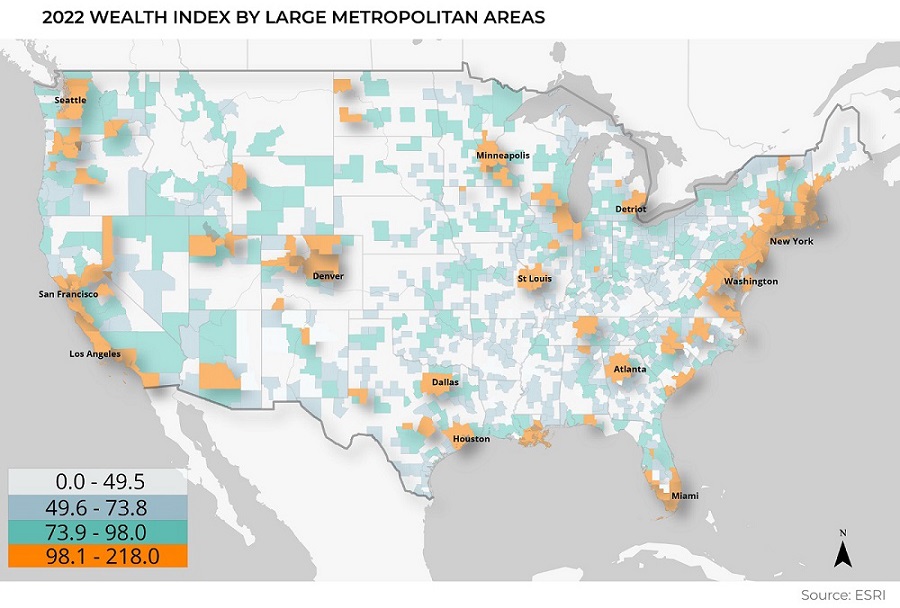

A byproduct of this growth is increased wealth, disposable income and consumption. South Florida ranks among the country's highest regions for wealth and average home value. Most of its wealth is created by jobs and rising wages across all employment categories, leading to greater demand for goods and services. South Florida registers 99/100 on the Wealth Index and 86/100 on the Housing Affordability Index.

South Florida registers 99/100 on the Wealth Index and 86/100 on the Housing Affordability Index.

Diversity Attracts Investment

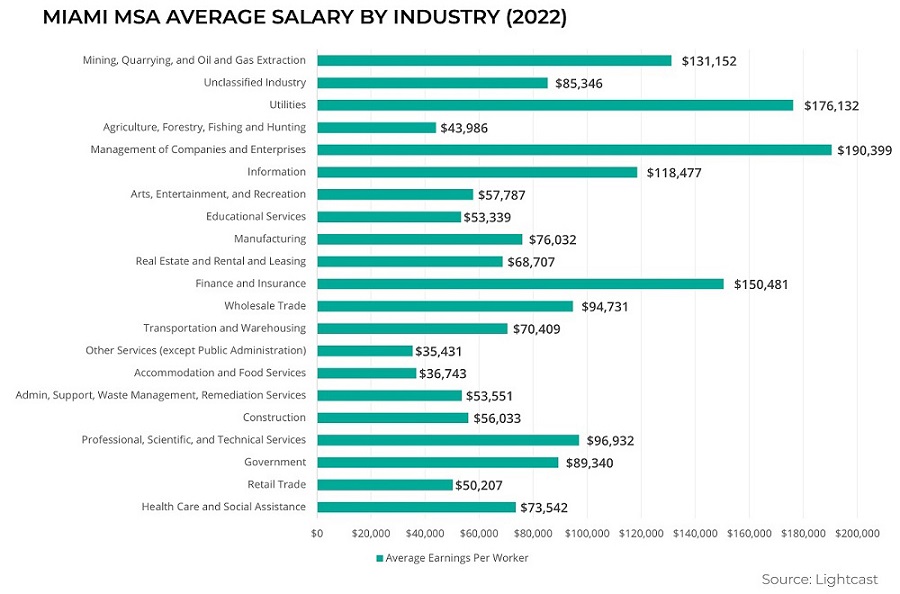

South Florida’s status as a top migration destination significantly contributes to its growth and the resulting influx of capital. The economy has become increasingly more diverse, experiencing a rise in management, utilities, finance and insurance positions.

More than 40% of South Florida’s population is foreign-born, making it one of the most multicultural markets in the nation. This diversity fuels migration and attracts major industries seeking access to a multicultural and highly talented labor pool.

More than 40% of South Florida’s population is foreign-born, making it one of the most multicultural markets in the nation. This diversity fuels migration and attracts major industries seeking access to a multicultural and highly talented labor pool.

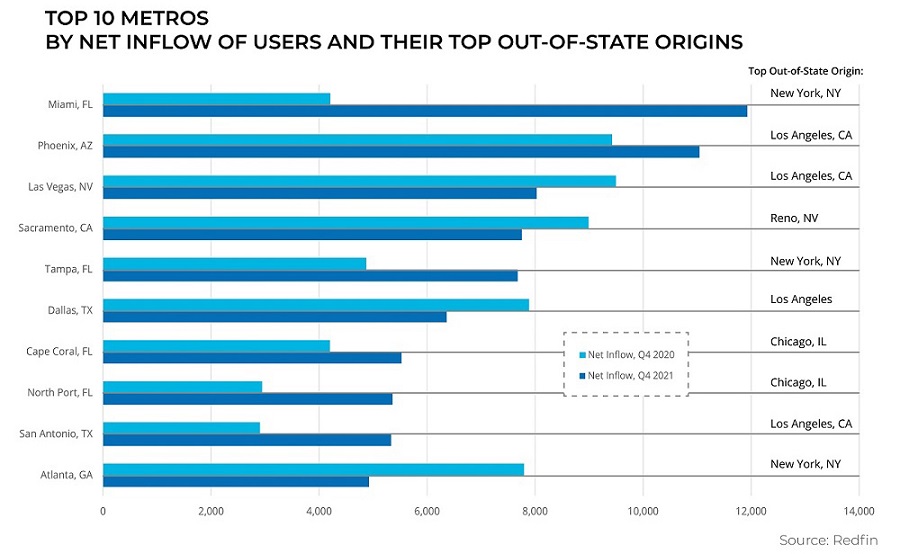

Migration to the Sunbelt has ticked up since the pandemic’s start with South Florida topping the list for the last year of full data in 2021. While Latin Americans continue to migrate to South Florida and seek proximity to the “gateway to the Americas,” New York was the top domestic contributor to population growth as northerners search for warmer weather and lower taxes.

Migration to the Sunbelt has ticked up since the pandemic’s start with South Florida topping the list for the last year of full data in 2021. While Latin Americans continue to migrate to South Florida and seek proximity to the “gateway to the Americas,” New York was the top domestic contributor to population growth as northerners search for warmer weather and lower taxes.

Rebounding Tourism Drives Hospitality

South Florida is a preeminent destination and transit point for tourists across the Western Hemisphere, contributing to the vibrant and prosperous local economy. Although tourism took a major hit in 2020 due to the pandemic, the region recovered considerably in 2021 and accelerated tremendously in 2022, surpassing pre-pandemic levels.

Activity in the cruise industry, one of South Florida’s primary tourism drivers, picked up considerably in 2022 after a 90% decline during the pandemic, and 2023 is anticipating a return to pre-pandemic levels.

South Florida’s hotel occupancy has long benefited from the cruise industry for pre- and post-cruise stays. However, the sector has matured and expanded by hosting major events like the Pegasus World Cup Invitational, F1 Grand Prix and the Miami Open. The region’s climate and accessibility also make it a desirable destination for conferences and conventions. The diversified hospitality demand elevates occupancy, increases room rates and raises the region’s international profile.

The Trade Gateway to the Americas Records Busiest Year

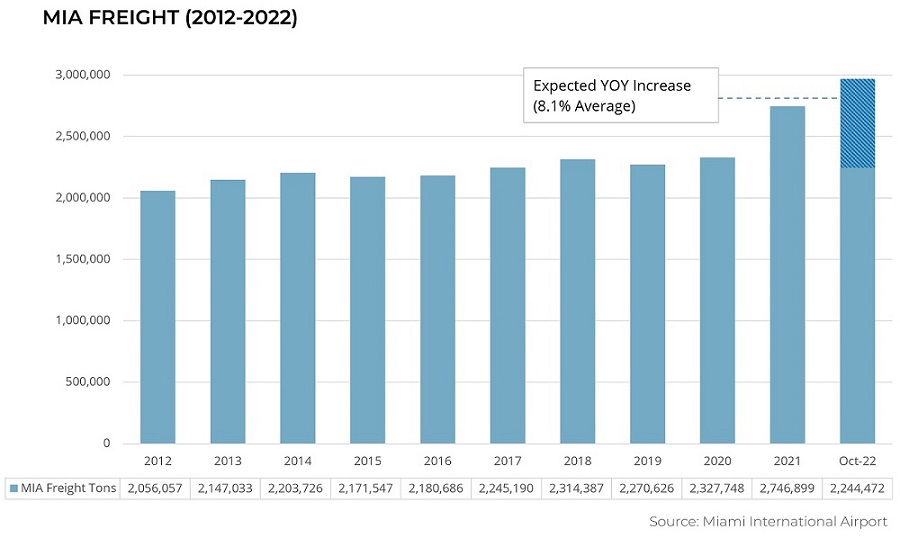

South Florida’s position as Gateway to the Americas has never been more vital with record trade by air and sea in 2022.

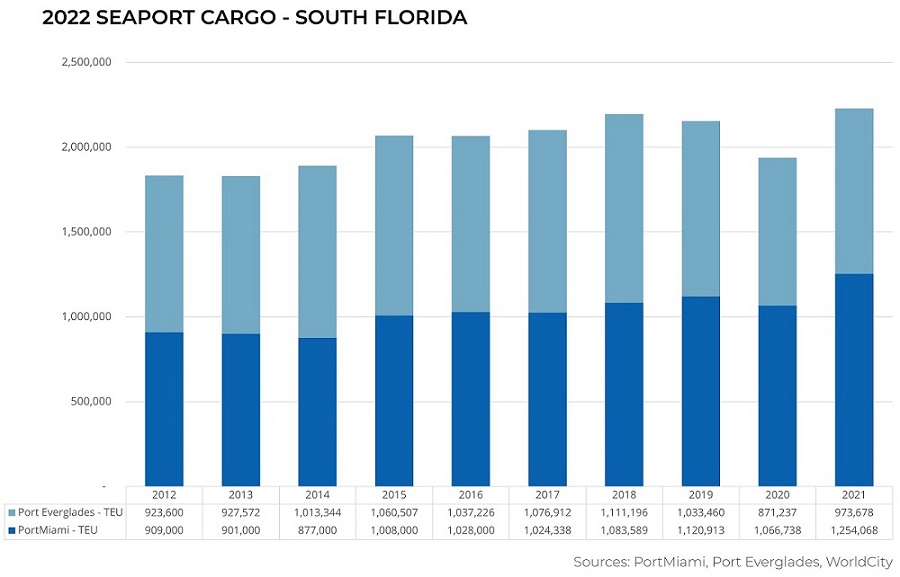

The Port of Miami, one of the nation’s fastest-growing ports, saw its busiest year in 2021, recording volume figures nearly 17% higher than 2020 and more than 12% higher than 2019 pre-pandemic totals.

Now, the industrial market is poised to benefit from the growing trend of nearshoring as potential manufacturing shifts from the Eastern Hemisphere to countries around the Caribbean Basin and South America.

Now, the industrial market is poised to benefit from the growing trend of nearshoring as potential manufacturing shifts from the Eastern Hemisphere to countries around the Caribbean Basin and South America.

Strengthening the sector, GDP growth in Latin American countries rebounded from 2020 pandemic lows, and the IMF forecasts this trend will continue over the next few years, potentially surpassing record levels set in 2013.

Rents Rise with Industrial Space Demand

South Florida’s industrial real estate market is driven by solid demand from freight, logistics and e-commerce companies as well as traditional distribution, service and light assembly. The region has reached a critical mass where the consumption of the existing population alone drives demand for warehouse space.

Latin American and European trade also contribute to growing space needs. While a significant percentage of goods received through South Florida’s ports is consumed locally, the largest share is trans-shipped to Latin America and the Caribbean.

The region consistently attracted business and people during the pandemic recovery while outperforming the nation in industrial real estate demand. Supply constraints coupled with booming industrial real estate growth are driving developers to get creative to add new industrial product, including going vertical.

Despite the many barriers, including environmentally challenged land and heavy competition from the housing and hospitality industries, construction spending in 2022 increased 8.8% from 2021 to $9.3B. A total of 7 million square feet was delivered in the fourth quarter alone.

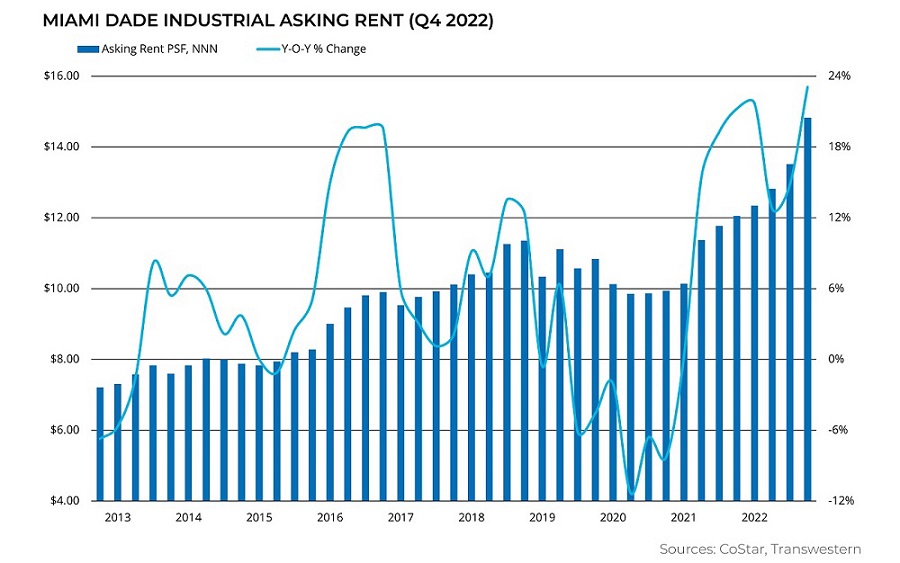

Tenants continue to absorb industrial real estate amid constrained supply, pushing asking rents to record levels and resulting in a 36 MSF increase in occupied space in Miami-Dade during the last decade.

South Florida’s Endurance

South Florida’s Endurance

The four-legged stool of demand drivers – consumption, growth, hospitality and trade – position South Florida for resiliency today and well into the future. If any one of the sectors faces headwinds due to a U.S. or Latin American slowdown, the others are sturdy enough to keep the regional economy from experiencing a dramatic downturn. This bodes well for the South Florida’s industrial real estate market, where product remains in high demand.

Walter Byrd serves as Executive Managing Director of Transwestern’s national industrial group. His South Florida team represents some of the largest corporate users in the market, leases properties on behalf of institutional owners, and facilitates the acquisition and disposition of commercial real estate assets.

SEE ALSO:

- Forecasting the Future of Warehouse Demand

- Bracing for Distress

- Dissecting Replacement Costs

- Unpacking Port Congestion

RELATED TOPICS:

commercial real estate

industrial real estate

capital markets

market reports