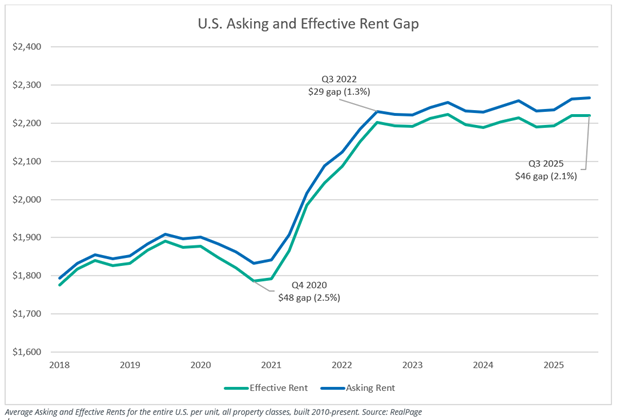

Since 2018 there have been two peaks in concession offering: late 2020 and 2025. Landlords begin offering concessions when there is excess supply in the market, slow leasing demand, or a combination of the two, in order to attract tenants. The U.S. saw a spike in new multifamily construction during 2021 and 2022 in response to rapid rental rate growth and record-low vacancy. This influx of supply has led to rental rates flattening, and more concessions being offered.

Head South for New Construction and Concessions

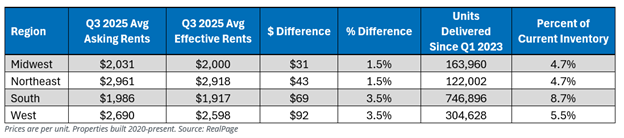

Regionally, the South has led the country in concession activity, which also has seen the largest influx of new supply since 2023. Demographics and population movements play a key role in multifamily demand, and the South and Sunbelt regions have seen population growth and corresponding development over the last few years.

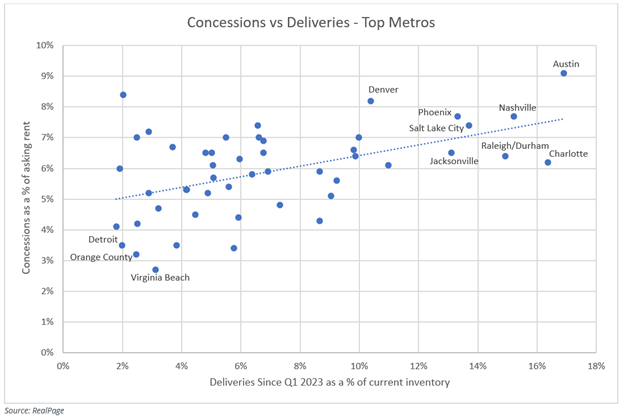

Concessions Follow New Deliveries

The precursor for elevated concessions is usually an influx in new supply or other economic pressures that prompt landlords to give money back to tenants to fill their rent roll.

The highest growth metro areas, located primarily in the Sunbelt and Southeast U.S., all have elevated concessions as a percentage of asking rent. Low-development markets such as Detroit, Virginia Beach, and Baltimore have correspondingly low concessions. Austin has seen the most deliveries relative to market size since the start of 2023 with over 58,000 new units completed.

Based in Atlanta, Spencer Papciak is the National Multifamily Research Leader. He oversees multi-market data and analytics, delivering strategic market intelligence to Transwestern teams, clients and partners across the platform.

To compare the change in concessions over time in select metros, click here.

SEE ALSO: U.S. Market | U.S. Multifamily

RELATED TOPICS:

commercial real estate

market reports

agency leasing

tenant representation

Spencer Papciak

Director of Research - Southeast | National Multifamily Research Leader

Atlanta, Georgia