After posting impressive growth metrics for years, the pandemic pushed the e-commerce sector into overdrive as most consumers lived, worked and shopped from the confines of their home. The increase in online purchases drove U.S. retail e-commerce sales to $223 billion during midyear 2021, a 43.9% increase from the period immediately preceding the pandemic, and a 57% rise when compared to midyear 2019.

At the same time, supply chains have been stressed by unprecedented circumstances. Facilities across the globe suffered temporary shutdowns due to health precautions, and certain products were stockpiled by shoppers who foresaw the inevitable: a big wrench thrown into finely tuned logistics operations.

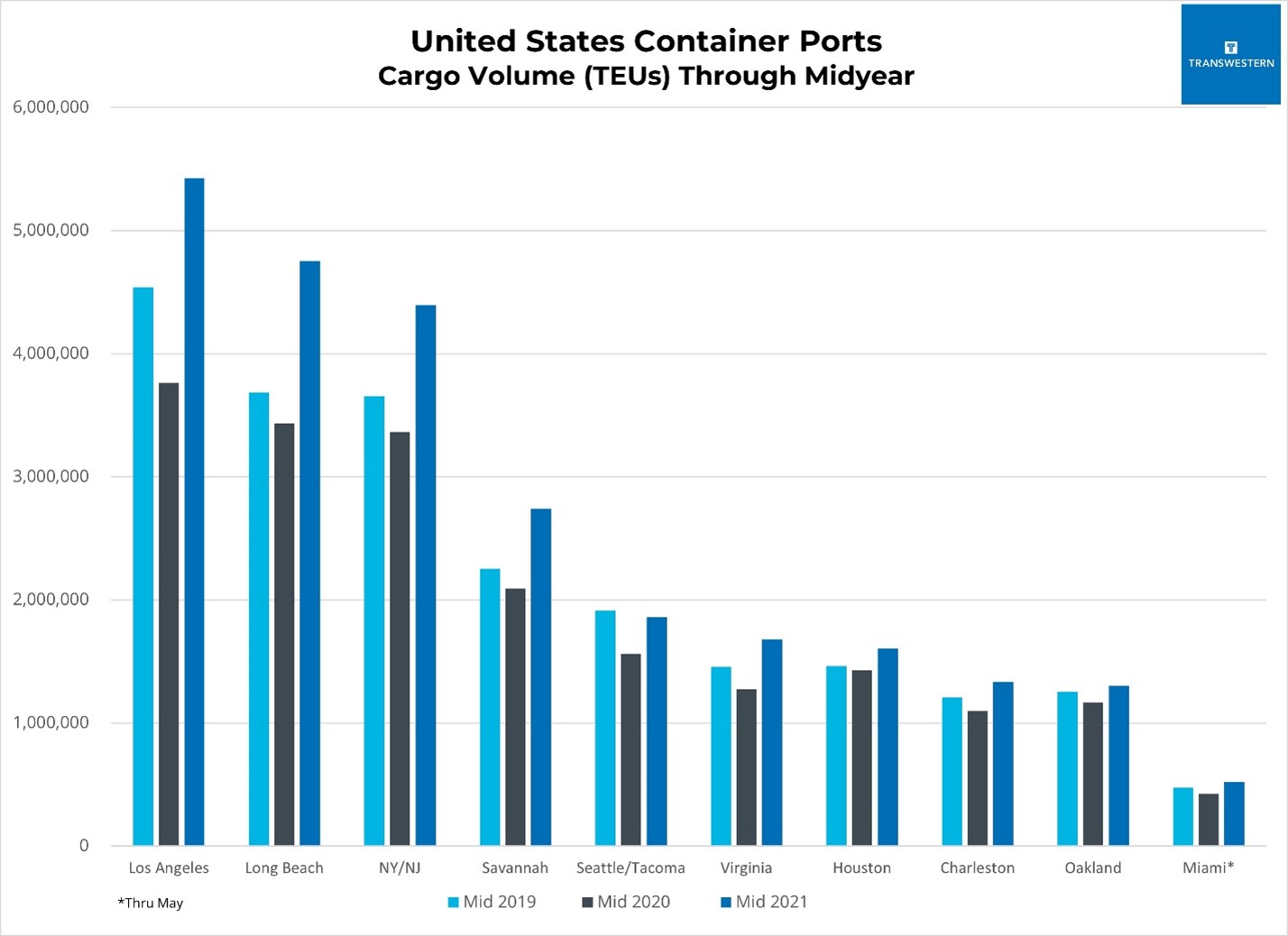

The disruption to supply chains due to COVID-19 caused port volumes to dip early in 2020, but as Transwestern research shows, port activity has more than recovered since, and is on pace to break records across the U.S. in 2021. Therefore, if product is arriving on U.S. shores, why are we still clamoring for technology equipment, cars, clothing and many household goods?

For decades, logistics experts have focused on trimming inefficiencies from supply chains, striving for just-in-time delivery scenarios that reduce the cost of storing and moving goods. The backlog created by stalled manufacturing and distribution activities, coupled with pandemic-induced e-commerce behaviors, greatly upset the balance between supply and demand, and is the reason why you’re constantly refreshing “Track Your Order” to no avail.

Don’t expect that to change any time soon, as the supply chain is expected to significantly impact the 2021 holiday shopping season and remain congested well into 2022.

A variety of factors contribute to the ongoing ripple effects from the trade collapse experienced last year, but a few stand out. One, logistics personnel remain hesitant about going back to work. This has resulted in labor shortage for ports, rail, trucking, distribution centers – all vital in moving goods to their destinations. Two, consumers of all ages, including baby boomers, have grown more comfortable than ever with shopping online – even for groceries.

This confluence of events has resulted in a volume of e-commerce that has significantly exceeded labor availability and the pace of port expansion, pushing delivery services to capacity and fueling widespread demand for cold storage facilities that the pandemic brought to the forefront of the industrial sector.

SIGNFICANT U.S. PORT TRENDS

- Total volume for the top 10 ports increased by 28.9% when comparing midyear 2021 to midyear 2020.

- Port of Los Angeles, the nation’s largest port, is growing 48% faster than the U.S. average for 2021 and set a Western Hemisphere record for processing 10 million units in a 12-month period, while neighboring Port of Long Beach broke monthly cargo records in 12 of 13 months through July 2021.

- The bottleneck at ports across the West Coast is causing companies to look for entry points on the East Coast, where congestion is less of a problem.

- Total cargo volume for Port of New York/New Jersey was nearly 50% higher when comparing midyear 2021 to midyear 2020.

- In April, Port of Miami welcomed the largest container ship ever to Florida and is anticipated to have its biggest year ever for cargo volume.

- Port Houston, where a recent agreement was signed to widen and deepen its ship channel, reported its biggest month ever for cargo volume in July 2021 while recording double-digit growth for the fifth month this year.

Supply chain strategies are constantly evolving to meet new demands, but unlike two-day shipping, logistics operations do not turn on a dime. Solving for labor shortages and adapting to new consumer trends must be coupled with greater port efficiencies.

Additionally, there’s a new generation that is influencing decisions on this monumental topic, Gen Z. Also referred to as Zoomers, this segment of the population has been immersed in technology since the early stages of life and will soon be at the forefront of e-commerce consumers. Understanding how to best meet the needs of this demographic is critical to success.

Matt Dolly is Director of Research for Transwestern. He delivers local and national commercial real estate and economic trends, analyses and reports to team members, clients, prospects and the media.

SEE ALSO:

- Midyear 2021 Elite 11 U.S. Industrial Markets Report

- Second Quarter 2021 U.S. Industrial Market Report

RELATED TOPICS:

commercial real estate

real estate

industrial real estate

market research

market intelligence

market reports