Retail data shows that U.S. consumers continue to spend at a relatively stable rate, despite the rising prices that have plagued all segments of the economy. In 2022, consumer spending, adjusted for inflation, increased 2.7% from the prior year, even though month-over-month change was somewhat uneven.

Yet one notable shift underscores how different the retail environment is today versus pre-pandemic, and that is where dollars are being directed. The trend has the potential to impact a number of commercial real estate sectors.

FOLLOW THE MONEY

Nationally, consumers today are spending approximately 5% more on services than goods than they did in 2021. The U.S. Bureau of Economic Analysis (BEA) reported that spending on services increased to $8.7 trillion in 2022, up more than $372 billion from the previous year. Comparatively, spending on goods decreased by $26 billion to $5.5 trillion in the same period. These figures are adjusted for inflation.

What service segments have benefitted the most from this shift? Two categories that have seen a notable uptick are gym memberships and travel. For example, Planet Fitness added 400,000 members to its roll in 4Q22, bringing total membership to roughly 17 million. The company, as well as its competitor Xponential Fitness, have experienced significant membership growth when compared to pre-pandemic levels, illustrating the fact that consumers are prioritizing physical and mental wellbeing neglected during lockdowns.

Similarly, once they were permitted to travel without onerous restrictions, consumers returned in earnest. Airlines saw the biggest boost in spending, but hotels, car rental agencies and restaurants also experienced a surge. In fact, travel and leisure spending has surpassed pre-pandemic levels, according to data from the BEA. For example:

- Air travel spending increased 32.9% from 2019 ($116.4B) to 2022 ($137.3B)

- Hotel spending increased by 25.2% from 2019 ($105.3B) to 2022 ($112.1B)

So far, 2023 travel spending remains elevated, with spending in February totaling $93 billion – 5% above 2019 levels and 9% above 2022 levels. A report from American Express suggests this trend with continue, with 78% of respondents agreeing that leisure travel is an important budget priority.

UNDERSTAND DYNAMICS AT PLAY

The pandemic has been in our rear-view mirror for a while now, so what has kept spending so strong, especially in light of stubborn inflation? Several factors have contributed to this trend:

- First, wage growth. While wages slowed over the last three months, they remain high in a broader context. Annual wage growth declined to 6.1% in January from a peak 6.7% over the summer of 2022, according to the Federal Reserve Bank of Atlanta. However, this is still higher than any pre-pandemic point, with wage growth averaging 3.6% over the past 25 years.

- Second, rising Social Security benefits. Recipients benefited from an 8.7% increase in January 2023, the largest cost-of-living increase in four decades.

- Third, residual funds from pandemic-era relief payments. Simply put, people who received government financial support still have savings to spend. In one analysis, Wells Fargo estimates that households have about 10 more months of spending power if they continue to deplete excess savings at the rate established over the last six months.

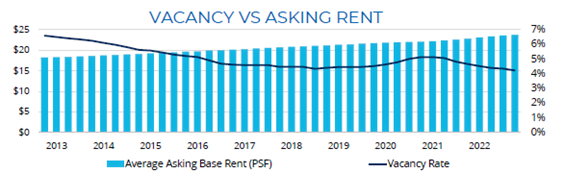

All of this has been a boon for retail real estate. Leasing has been healthy as retailers expand. The average vacancy rate for U.S. retail properties at year-end was 4.2%, lower than the pre-pandemic level. And all retail categories – except for malls – had positive net absorption in 2022.

Asking rents were up 4.2% year-over-year in 4Q22 as retail demand has been steady and the vacancy rate is low enough to justify rent bumps after slowing rent growth in 2020. Furthermore, rent growth has been bolstered by less retail space under construction and lower-than-average starts of new projects as retailers and developers reevaluate space needs.

CONSIDER IMPLICATIONS FOR REAL ESTATE

There are two divergent paths for retail spending that will impact retail space usage.

Consumers want to save on goods that they need daily such as groceries and personal items. Big-box retailers and discount retailers continue to perform well and will still be in demand as consumers try to find low-cost options. For example, Walmart U.S. in-store revenues increased 6.9% from 2022, Costco fiscal year 2022 revenue totaled $222.73 billion, up 16% from $192 billion in fiscal year 2021, and Target 2022 revenues increased by 2.8%, from $106.8 billion in 2021 to $109.1 billion in 2022.

E-commerce sales also grew: Walmart U.S. experienced a 12% annual increase in fiscal year 2022 and Costco’s saw an increase of more than 10% during the same time. While there is a shift from goods to services, demand for logistics space will remain strong due to steady retail demand.

Consumers are willing to spend more on experiences, and this shows no signs of slowing. Spending on travel/leisure positively impacts restaurants, hotels and retail stores. American Express reports that 85% of survey respondents are planning to take two or more leisure trips in 2023.

Steady consumer spending has been the one constant that has kept the economy growing at a steady pace. Fortunately, big issues impacting retail have subsided to some degree, including supply chain disruptions and runaway inflation.

That said, consumer confidence is shaky as concerns about the economy persist and may result in a pull-back of spending. Retail property owners and tenants should plan for multiple scenarios over the next 12-24 months, such as more flexible lease terms and additional incentives such as free rent, as history has proven time and again the fickle nature of consumers.

Maurice Harris is the Research Manager for Transwestern’s Minneapolis office and serves as research lead for Retail Services nationally.

SEE ALSO:

- U.S. Retail Market Overview

- Coffee Break: Understory

- Pandemic Swings the Port Pendulum

- Time for a Menu Refresh?

RELATED TOPICS:

commercial real estate

real estate

retail

market research