Elevated Construction Activity Could Affect Vacancy, Net Absorption in Coming Quarters

February 03, 2020

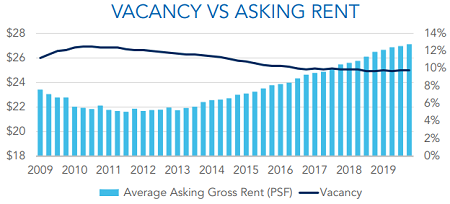

Houston – Despite some trepidation in the commercial real estate industry heading into 2020, the office market closed the year strong, according to Transwestern’s latest U.S. office market report. Annual average asking rental rates grew 2.3% year over year, ending the quarter at $27.08 per square foot. Markets exhibiting the greatest rent growth included Tampa (10.6%), San Francisco (8.7%), Pittsburgh (8.4%), California’s Inland Empire (8.4%) and Manhattan (8.0%).

U.S. payroll jobs grew 2.2% in the 12 months that ended Dec. 31, and of the 2.1 million new jobs added, 598,000 were office-using positions. The technology and financial services industries, which are dominant players in the high rent-growth markets noted above, each accounted for 20% of total job growth, with the medical and business consulting industries also making considerable contributions to new demand.

“A durable economy combined with strong business confidence positions both tenants and landlords well for 2020,” said Elizabeth Norton, Managing Research Director at Transwestern. “However, trends do indicate that market fundamentals, although healthy, may start to decelerate slightly.”

For example, while the national average vacancy rate remains below 10%, it ended the year 10 basis points higher than one year ago. Similarly, although U.S. net absorption topped 15 million square feet in the fourth quarter, led by Chicago and Dallas-Fort-Worth, the 2019 total of 62.8 million square feet is significantly below the prior year’s total of 84.8 million square feet.

Meanwhile, construction activity has not receded, growing 11.3% during the past 12 months. Currently, Manhattan, Austin, Boston, Seattle, and Dallas-Fort Worth lead the nation in square footage under construction. When compared to total market inventory, the greatest percentage of space under construction is occurring in Austin, Nashville, Charlotte, San Jose/Silicon Valley, Seattle and Salt Lake City, all registering above 5%, with Austin’s new construction topping 14% of current inventory.

“There is some concern in a number of markets that office construction deliveries will outpace demand over the next year or two, and this ultimately could give tenants some negotiating leverage,” Norton added.

Download the full fourth quarter 2019 U.S. office market report at: https://twurls.com/us-office-4q19

ABOUT TRANSWESTERN COMMERCIAL SERVICES

Transwestern Commercial Services (TCS) is a privately held real estate firm of collaborative entrepreneurs who deliver a higher level of personalized service and innovative client solutions. Applying a consultative approach to Agency Leasing, Asset Services, Occupier Solutions, Capital Markets and Research, our fully integrated global organization adds value for investors, owners and occupiers of all commercial property types. We leverage market insight and operational expertise from across the Transwestern enterprise, which includes firms specializing in development and real estate investment management. TCS has 34 U.S. offices and assists clients from more than 200 offices in 37 countries through strategic alliances with France-based BNP Paribas Real Estate and Canada-based Devencore. Experience Extraordinary at transwestern.com and @Transwestern.

ABOUT TRANSWESTERN

The Transwestern enterprise comprises diversified real estate services, investment management and development companies. The privately held, fully integrated organization leverages competencies in office, industrial, retail, multifamily and healthcare to add value for investors, owners and occupiers of real estate.

Media Contact:

Stefanie Lewis

713.272.1266

stefanie.lewis@transwestern.com

twmediarelations@transwestern.com