Rise in Sublease Space Presents Favorable Market Conditions for Tenants

April 19, 2021

New York City – Manhattan’s office market closed the first quarter of 2021, and the first full year of the pandemic, by posting record low levels of leasing activity, increased sublet space and decreased, though fairly stable, rent figures, according to a new research report from Transwestern Real Estate Services.

New York City – Manhattan’s office market closed the first quarter of 2021, and the first full year of the pandemic, by posting record low levels of leasing activity, increased sublet space and decreased, though fairly stable, rent figures, according to a new research report from Transwestern Real Estate Services.

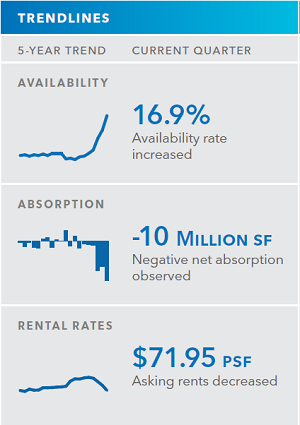

During the first quarter, Manhattan tenants leased just over 3.9 million square feet of office space, representing the lowest total in at least 15 years. Meanwhile, asking rents in Manhattan fell to $71.95 per square foot, down 4.9% from the prior quarter and 11.7% from first quarter 2020, when rates hit an all-time high just before the onset of the pandemic.

The rise in sublease space began before COVID-19 and accelerated in third quarter 2020. Sublet availability now stands at 4.7%, up from 2.8% a year ago. Sublet space has similarly grown as a percent of overall availability, from 19.6% of overall space in first quarter 2018 to its current 27.8%, an increase of 42%.

“While the past year has been certainly difficult for the office market, fundamentals have remained more stable than some projected and we’ve begun to see a notable increase in interest from tenants to take advantage of current conditions,” said Patrick Heeg, Transwestern Partner. “The market has shifted toward tenants’ favor, with asking rents down from recent highs and a 66% increase in sublease space availability. Much of the recent leasing activity has involved short-term deals and we expect to see an uptick in activity, as tenants seek to lock in longer-term leases.”

Additional highlights from the report include:

- First quarter leasing activity of 3.9 million square feet was approximately half the Q1 2020 activity and 54.5% below the 5-year average of 8.6 MSF/quarter.

- The availability rate for Manhattan is currently 16.9%, its highest figure since the last recession.

- Availability is up from 11.4% in Q1 2020 and up from 14.8% last quarter.

- 53 blocks of space exceeding 50,000 square feet were added to the market, totaling nearly 6.2 million square feet, roughly double last quarter’s large block additions.

- While sublet space was a major factor for space additions, about 60% of large block additions were for direct space.

- Absorption in Q1 2021 was negative 10 million square feet, the worst total on record, at least since the last recession.

“In addition to an increase in overall availability, the volume of sublet space has been watched closely over the past two quarters, though it had begun trending upward even before March of last year,”, said Corrie Slewett, Research Manager, Transwestern. “While the pandemic is still in the driver’s seat, it is loosening its grip as workers return to the office amidst rising vaccination rates. We are encouraged by the increased market activity we are seeing.”

Download the first quarter 2021 Manhattan office report at https://transwestern.com/market-reports.

Media Contact:

Dan Foley

508.272.0017

dan.foley@transwestern.com

twmediarelations@transwestern.com

Corrie Slewett

Research Manager - New York | National Tenant Advisory Research Leader

New York, New York