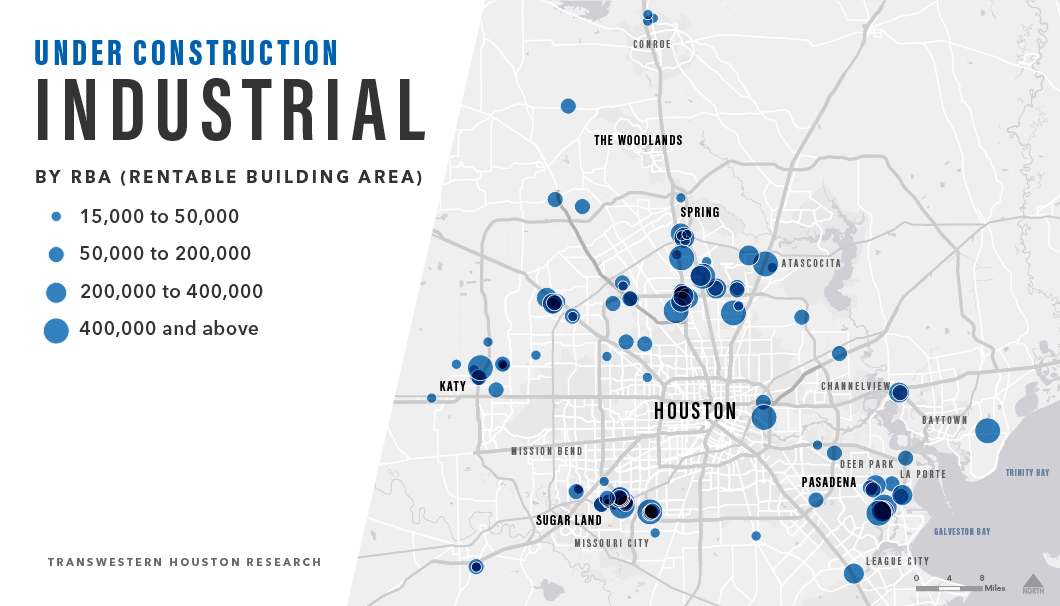

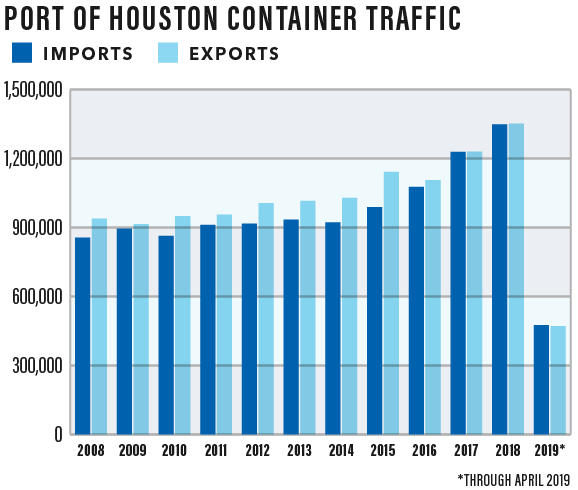

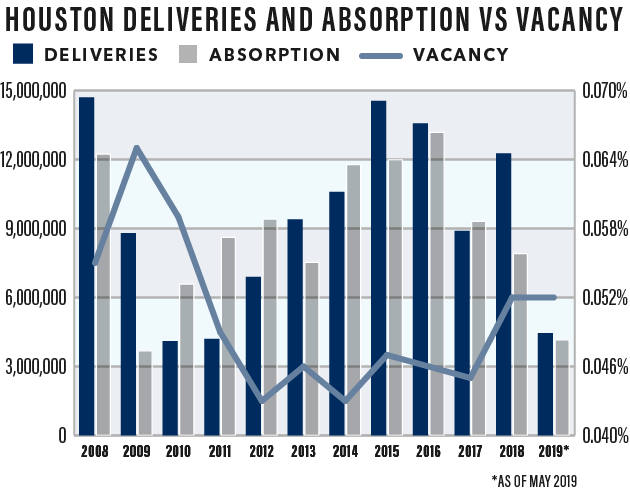

Fueled by the rapidly growing e-commerce sector, increased activity at the Port of Houston, and the city’s continued high population growth, demand for industrial real estate product in Houston has kept vacancy rates low and pushed the construction pipeline to an all-time high of 21.2 million square feet across the metro.

While industrial construction activity has been dominated by build-to-suit activity over the past few years, developers are modifying their strategy to get ahead of requirements with a wave of speculative construction. As a result, the current industrial construction pipeline is 74% speculative space, totaling 15.7 million square feet set to deliver over the next 18 months – an increase of 268% year over year. While that may seem like a staggering number, the dynamic growth in the market is needed as e-commerce chases rooftops and Houston evolves into a hub to serve the growing Austin and San Antonio markets. Industrial construction activity is most prominent in the following submarkets:

North Submarket – Driven by proximity to George Bush Intercontinental Airport and the rapid expansion of The Woodlands and surrounding communities, the submarket has expanded from 85.6 million square feet to 95.3 million square feet over the previous five years. This growth has been fueled by tenants such as Coca-Cola, Grocers Supply and Conn’s HomePlus committing to large blocks of space. Currently, the submarket has 7 million square feet under construction across a total of 37 projects with 4.3 million square feet of speculative industrial construction.

Largest Construction Projects

Northwest Submarket – The Northwest submarket has long been Houston’s top performer with the ability for properties to serve Cypress, The Woodlands and Katy. As a preferred location, the Northwest market accounts for 31.5% of Houston’s total industrial real estate supply. Large users such as Home Depot, Southern Glazer’s, and Goodman Manufacturing have signed leases for industrial space in the Northwest submarket. Limited land availability has slowed growth in this market; yet, it still accounts for 3.4 million square feet under construction across 28 total projects with 3 million square feet of that being speculative industrial construction. This includes Sam Houston Distribution Center, a speculative industrial project by Transwestern Development Company.

Largest Construction Projects

Southeast Submarket – The Southeast submarket serves the Port of Houston and, as is the case with the Northwest, is one of the top performers in the city, comprising 17.6% of the overall market. With increased trade volume going through the Port of Houston and growth expected to continue, demand for industrial space for rent in the Southeast remains high with tenants such as Plastic Bagging & Packaging, Valvoline and Plantgistix inking recent deals. As such, a total of 5.6 million square feet is under construction across a total of 21 projects with 4.6 million square feet of speculative industrial construction.

Largest Construction Projects

Southwest Submarket – The Southwest submarket is one of the smaller industrial markets in the city as geographical coverage from the Southeast is tightly centered around the Sugar Land/Missouri City area. That said, the buying power of the area has drawn major tenants such as Best Buy, Men’s Warehouse and FedEx. Strong leasing activity from major retailers has resulted in an uptick in industrial construction with 4.1 million square feet underway across 41 total projects with 3.1 million square feet of speculative construction. This includes the Southwest Commerce Center, a speculative industrial project by Transwestern Development Company.

Largest Construction Projects

The heightened industrial construction activity has shown no signs of slowing. Correspondingly, rents are anticipated to remain stable while vacancy will likely tick up slightly due to the high speculative industrial construction.

Rachel Hornbeak assists the Houston research team in analyzing the local real estate market and economy to identify trends and opportunities.

SEE ALSO:

- U.S. Industrial Market Research Report - Q1 2019

- Slowing Economy Steadies for Extended Run

- Infrastructure Not Making the Grade

RELATED TOPICS:

industrial real estate industrial construction industrial development speculative development Houston real estate commercial real estate real estate