Transwestern Report Finds Full Leasing Pipeline Should Give Strong Close to 2019

October 31, 2019

New York City – The Manhattan office market cooled during the third quarter, recording 5.7 million square feet in leasing activity, down 33% from last quarter, and negative net absorption of 1.7 million square feet. Despite the slowdown in leasing, average rents remained high, closing a second consecutive quarter above the $80 mark at $80.24 and down only slightly from last quarter’s record high of $80.37. The findings were released in a quarterly research report on the Manhattan commercial real estate market from Transwestern Commercial Services.

New York City – The Manhattan office market cooled during the third quarter, recording 5.7 million square feet in leasing activity, down 33% from last quarter, and negative net absorption of 1.7 million square feet. Despite the slowdown in leasing, average rents remained high, closing a second consecutive quarter above the $80 mark at $80.24 and down only slightly from last quarter’s record high of $80.37. The findings were released in a quarterly research report on the Manhattan commercial real estate market from Transwestern Commercial Services.

“We saw a significant slowdown in Manhattan leasing during the third quarter, particularly when compared to last quarter and the same period last year,” said Danny Mangru, New York Research Manager at Transwestern. “At the same time, a number of large blocks became available, so demand was simply not keeping up with supply. However, the market is still in a very strong position: rental rates are still at near-record highs, and we are tracking an active pipeline for fourth quarter and beyond that looks very full. We anticipate the market closing 2019 on a strong note, on par with or higher than the historical averages.”

Additional highlights from the report include:

- Manhattan year-to-date leasing activity totals 21.2 million square feet, down 12% from the same period last year.

- There were 17 new leases in the third quarter exceeding 50,000 square feet, including six topping 100,000 square feet.

- The FIRE (finance, insurance and real estate) and TAMI (technology, advertising, media and information) sectors accounted for almost half of all leasing activity.

- Coworking activity remained strong, representing 10% of leasing activity.

- The Midtown market tallied 2.1 million square feet in negative absorption.

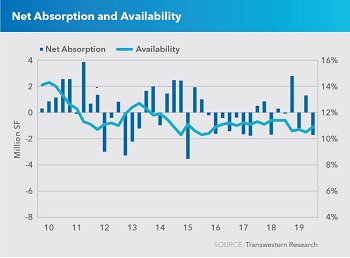

- The availability rate closed at 10.9%, up from 10.5% last quarter.

- 13 blocks of space exceeding 100,000 square feet were added in the quarter.

- The Downtown and Midtown South submarkets posted their lowest availability rates since 2016, at 12.0% and 8.2%, respectively.

Download the third quarter 2019 Manhattan office report at: https://transwestern.com/market-reports.

ABOUT TRANSWESTERN COMMERCIAL SERVICES

Transwestern Commercial Services (TCS) is a privately held real estate firm of collaborative entrepreneurs who deliver a higher level of personalized service and innovative client solutions. Applying a consultative approach to Agency Leasing, Asset Services, Occupier Solutions, Capital Markets and Research, our fully integrated global organization adds value for investors, owners and occupiers of all commercial property types. We leverage market insight and operational expertise from across the Transwestern enterprise, which includes firms specializing in development and real estate investment management. TCS has 34 U.S. offices and assists clients from more than 200 offices in 37 countries through strategic alliances with France-based BNP Paribas Real Estate and Canada-based Devencore. Experience Extraordinary at transwestern.com and @Transwestern.

Media Contact:

Dan Foley

508.272.0017 mobile

dan.foley@transwestern.com

twmediarelations@transwestern.com