Transwestern’s analysis of Real Capital Analytics data suggests that commercial real estate investors have exercised greater scrutiny in acquiring assets in recent years than at the end of the previous business cycle.

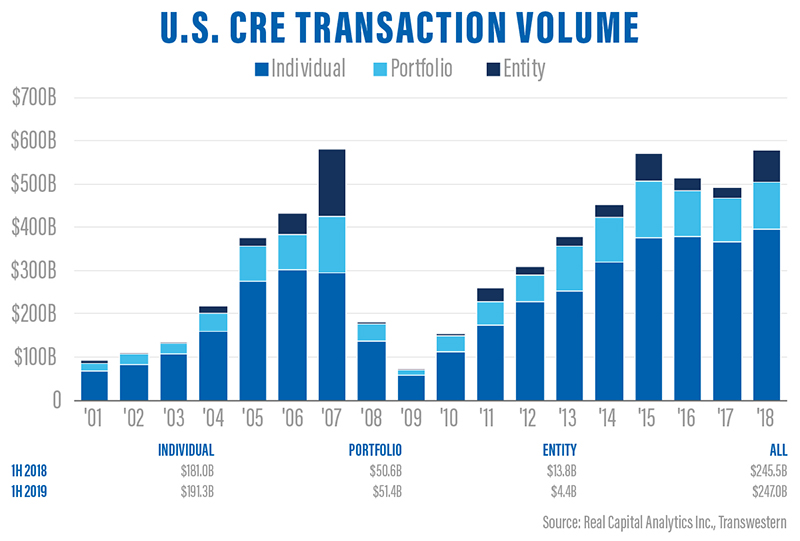

Although U.S. commercial real estate transaction volume in 2018 nearly equaled the previous peak of $581.6 billion set in 2007, acquisitions last year were significantly more likely to be individual property trades. One reason for that difference may be increasing investor caution, which helps to reduce risk for the commercial property sector.

Buyers typically base individual acquisitions on a property’s attributes and potential, while portfolio sales can hinge on overall performance driven by strong properties that mask weak or unproductive assets. Similarly, the condition or performance of real estate owned by an acquired entity may not be the investor’s primary motivation for the transaction. In that sense, more individual transactions represented in annual totals translates into less market risk, due to the greater care associated with one-off transactions.

Half (49%) of 2007’s volume was in portfolio and entity-level transactions, including Blackstone’s buyouts of Equity Office Properties Trust for $39 billion in February and of Hilton Worldwide Holdings for $26 billion in October. In 2018, by contrast, two-thirds of overall volume came from individual sales, while portfolio and entity deals contributed only 32%.

Real estate investment activity is leaning to even greater caution this year. Individual transactions made up 77% of overall volume in the first half of 2019, compared with 74% for the same period last year.